Renting an apartment in the USA

Are you currently planning your move to the USA? Then you will soon need your own apartment there. Learn the ins and outs of the US housing market and get essential tips on renting your first apartment in the United States.

- Am I allowed to live in the USA?

- How much does an apartment cost in the USA?

- Utilities in the USA

- Renters Insurance in the USA

- Finding an apartment in the USA

- Requirements for an apartment in the USA

- Documents for renting an apartment in the USA

- Tenancy agreements in the USA

- Paying rent in the USA

- Rental deposit in the USA

- Utility payment in the USA

- Electricity bills and electricity meters in the USA

- Apartment handover in the USA

- Duties of the landlord in the USA

- Obligations of the tenant in the USA

- 10 Tips for renting an apartment in the USA

Take the chance of living in the USA and apply for the official US Green Card Lottery!

Am I allowed to live in the USA?

Before you get to rent an apartment in the USA, you have to sort out your residence permit. Moving to the United States is the easiest if you have a Green Card.

The US Immigrant Visa (also called Permanent Resident Card) entitles you to live and work in the United States permanently. Also, with a Green Card, you enjoy almost all the rights of a US citizen and are free to choose both your place of residence and your employer.

The easiest way to get a permanent residence and work permit in the United States is to participate in the US government's annual Green Card Lottery, in which 55,000 immigrant visas are drawn.

How much does an apartment cost in the USA?

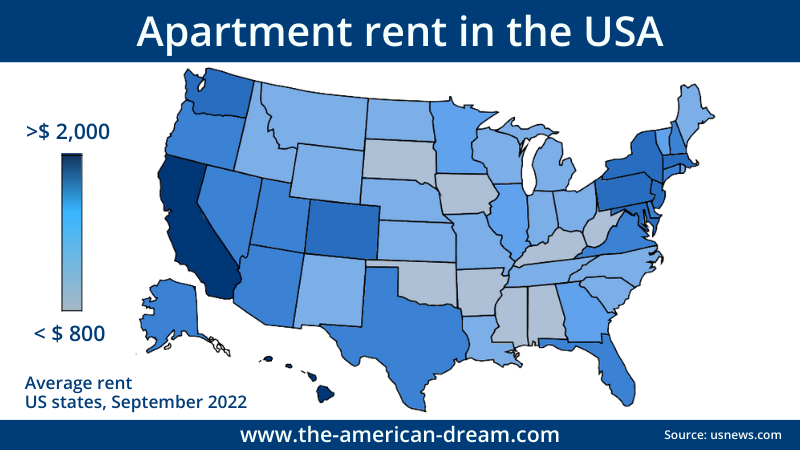

Rental prices in the US vary by region and location. A December 2023 report by private rental platform Zumper states that the average rent for US one- and two-bedroom apartments is $ 1,499 and $ 1,856 respectively.

However, rental prices vary greatly in different regions of the US, so local markets can vary considerably. High-priced markets can be found in cities like New York City and San Francisco, while mid-priced markets can be found in cities like Boston and Minneapolis. In contrast, the Midwest remains one of the most affordable places to rent due to lower demand and a wider selection of housing options.

You should expect to spend at least 30 % of your salary on renting an apartment in the US. By the way: In the United States, the terms "rent" ("rental housing", "rented apartment", "apartment for rent") and "lease" ("leased apartment", "leased residential", "for lease") are both commonly used for renting an apartment.

Utilities in the USA

Depending on where and how you live, the utility costs that you will pay in addition to the rent will vary. For example, if you move into a 60 m² apartment in hot and humid Florida on your own, you may pay more than $ 100 extra in electricity just for your air conditioning.

However, some leases in the USA include part of the utilities such as heating, hot water, and electricity in the rent. It is best to make a calculation to determine your total rental costs in the USA. Address the following questions:

- What utilities are included in the rent?

- What are the prices for gas/water/electricity/heating?

- What is my average consumption?

- What is the climate like in my state?

- Will I need to heat or use air conditioning more?

- What insurance (e.g., Renters Insurance) do I need?

- What TV and internet subscriptions do I need?

Tip

If you hire a real estate agent for your apartment search in the USA, they will be able to tell you the annual utility costs of a property or at least give you a fairly accurate price range.

Renters Insurance in the USA

Renters Insurance is a form of liability insurance policy for tenants. You are only obliged to take out this insurance if your future landlord requires it for the conclusion of a rental agreement.

A good Renters Insurance policy will cover the following:

- Damage to personal property

- Loss of usability of your apartment, including hotel costs, food, and transportation

- Coverage of medical expenses if someone is injured in your apartment

- Coverage for damage caused by pets

- Coverage for damages caused by floods and earthquakes

- Coverage for damage caused by power outages

Although Renters Insurance is not required by law, we recommend purchasing this insurance for every US immigrant before beginning an extended tenancy. It can protect you from major financial losses.

Finding an apartment in the USA

The housing market in the USA is as diverse as the country itself. You can really get it all, from a mini apartment in the big city to a spacious loft with an ocean view to a lodger flat in a somewhat conservative townhouse.

Popular platforms for apartment hunting in the USA include:

- zillow.com

- trulia.com

- forrent.com

- rent.com

When searching for apartments in the United States, keep the following quirks of the American housing market in mind:

- "1 bedroom" means "2 rooms," "2 bedrooms" means "3 rooms," etc.

- Many apartments are rented fully or partially furnished.

- You can sign a short-term (less than one month) or long-term lease (one year or longer).

- There may be a fee to check your credit score when you apply for an apartment. This fee is usually between $ 30 and $ 50.

Attention

You should become suspicious of unusually favorable offers or demands for money without prior viewing. Do a background check on your future landlord, e.g., via Internet platforms such as ratemylandlord.co or wyl.co.

Requirements for an apartment in the USA

When you apply for an apartment in the US, the first step is usually the credit check, which your prospective landlord will use to inquire about your credit score. If you haven't built up your credit history at the time of your apartment search in the USA, you'll probably have to make some rent payments in advance.

Tip

Since building a good credit score in the USA can take up to two years, many US immigrants use a trick: they get an American Express credit card back home and reissue it post-immigration.

Documents for renting an apartment in the USA

Once you have found the apartment of your dreams, you will apply to your potential landlord with a number of documents. If you are coming to the USA as an immigrant, you will have to put a little more on the table than an established American.

The following documents may be required of you when looking for housing in the US:

- Proof of identity (e.g., passport or driver's license)

- Your residency permit (e.g., Green Card or student visa)

- Your Social Security number

- Proof of your financial security (e.g., bank statement, proof of support)

- Proof of employment (e.g., a letter from your employer and pay stubs)

- Confirmation of scholarships or other funding (if studying in the USA)

- Confirmation from your former landlord that you are free of rent debts (certified translation)

Apartment hunting in the USA as a foreigner

The Fair Housing Act of the United States prohibits discrimination in housing based on national origin, race, color, religion, sex, disability, or marital status. This means that you may not be disadvantaged just because you are a US immigrant.

Tenancy agreements in the USA

American leases come in all shapes and colors. There are long-term and short-term agreements, digital and paper agreements, auto-renewing, and auto-expiring agreements.

Your rental agreement in the USA should include the following things:

- Start date of the lease

- The validity period of the contract

- Payment terms for rent and utilities

- Tenant obligations at the end of the contract

- Landlord obligations at the end of the contract

- Termination clause

- A clause on maintenance and repairs

- Deposit amount and repayment clauses

- Agreements on keeping pets, house rules, and special agreements

- Inventory list (for furnished apartments)

If rules of conduct and quiet hours are not specified in the contract, ask for house rules and familiarize yourself with them.

Good to know

If your landlord wants to change certain details of the contract (e.g., the amount of rent), they can do so when renewing your lease, but they must give you advance notice. This allows you to object to the automatic renewal in good time and, if necessary, look for another apartment.

Paying rent in the USA

Rent in the USA is usually paid in cash or by check. If your landlord also accepts payment by credit card, be sure to check if there are additional fees for doing so. Often, 3 - 5 % of the rental price is charged.

Rental deposit in the USA

You pay the rental deposit to the landlord before you move in. This is to ensure you will keep the rented property in good condition and to cover any damage you may cause.

About half of the states in the US have caps on rent deposits. Typically, you will pay between one and three and a half months' rent as a security deposit. You may also have to pay a separate deposit for pets in the apartment.

Obtain a receipt for the rent deposit paid. It should include the following:

- the amount paid

- the date of payment

- the reason for payment, including address and apartment number

- the tenants' and landlord's names

- the landlord's signature

Good to know

In some US states, security deposit accounts are required to earn interest. This means that after you move out, you get more money back than you have paid in. However, a rent deposit may be increased retroactively if, for example, the rent was increased.

Utility payment in the USA

Most utilities that are not included in the rent can be paid directly to the utility company by credit card.

Electricity bills and electricity meters in the USA

Monthly electricity costs in the USA are usually not assessed as a fixed amount but through regular meter readings by employees of the electricity company. This can lead to wide variations in the amount billed due to the different time periods between readings.

The American utility company PG&E (Pacific Gas and Electric Company) now offers payment of a monthly flat rate in order to avoid unpleasant surprises when billing.

What are electricity prices like in the USA?

According to the most recent evaluation by the U.S. Energy Information Administration in October 2023, the average monthly residential electricity bill in the United States in 2022 was $ 135.25. The evaluation is published approximately every two years on the eia.gov website.

Apartment handover in the USA

Before you move into your new apartment in the US, you should agree on the property's condition. On the day of the handover, you and your American landlord will walk through the apartment and record the current state of the premises.

The following things should be listed in the handover protocol:

- Meter readings

- Damage to walls, door, and window frames, furniture, floors, and ceilings

- The functionality of radiators, faucets, flushing toilets, and appliances (if any)

- Number of keys handed over

If you agree to make repairs, record this in the log. We also recommend that you take a picture of each room and document any damage or defects in detail.

Duties of the landlord in the USA

Your American landlord must comply with specific laws when renting you an apartment. However, these vary from state to state, so you should check local laws carefully before renting.

Some examples of obligations of a landlord in the USA:

- The habitability of the apartment must be guaranteed during the rental period.

- Before a person enters the apartment, they have to tell you in advance. 24 hours notice is recommended.

- Mold and other harmful substances in the building must be removed.

- Local laws regarding smoke and carbon monoxide detectors must be followed.

- Common areas and spaces must be free of hazards.

- The Fair Housing Act (FHA) and Fair Credit Reporting Act (FCRA) must be followed in the apartment application process.

- The tenant's personal and financial information must be kept secure and protected from third parties and may not be disclosed.

- Upon expiration and renewal of a lease, changes in lease terms must be announced well in advance. 60 days is recommended here.

Incidentally, your American landlord is only allowed to enter your rented apartment with good reason, e.g., for maintenance, repairs, or in case of an emergency.

Obligations of the tenant in the USA

If you rent an apartment in the USA, you must fulfill certain obligations during the rental period. These vary by US state, so you should check the local laws carefully before moving in.

Some examples of obligations of a tenant in the USA:

- The condition of the apartment must be maintained.

- Garbage must be disposed of regularly, and mold must be prevented.

- Severe damage from rust, dirt, and debris must be prevented.

- Co-leased furnishings and appliances must be cared for and maintained.

- Damage caused by the tenant or the tenant's pets and guests must be repaired.

- Local occupancy regulations (maximum number of people per m²) must be observed.

- The need for repairs to avoid significant damage (e.g., a leaking roof) must be reported to the landlord immediately.

- Subletting the apartment must be agreed upon with the landlord.

When you move out, you must leave the apartment in the same condition you took it over. However, normal wear and tear, such as a dull parquet floor, is usually not a problem after years of use.

10 Tips for renting an apartment in the USA

With our tips on apartment hunting and leases in the United States, nothing is standing in the way of a worry-free tenancy in the land of your dreams:

- Make a cost breakdown (budget vs. expected expenses).

- Stick to verified apartment listings on online platforms.

- Have necessary documents translated (including notarization.)

- Get a Green Card to get suitable housing with less hassle.

- Do some research on your potential landlord before giving him money or personal information.

- Ask your landlord to provide a utility bill from the past (as proof of legitimate tenancy).

- Explore your new neighborhood at your leisure before signing a lease.

- Check with the United States Census Bureau about your new neighborhood's demographics, health care, schools, potential employers, and other characteristics.

- Read the contract thoroughly and, if you are unsure, present it to a US tenant law attorney.

- Get renters insurance.

Have you already found your dream apartment in the United States? Congratulations, now the move can begin! However, don't forget that you will need permanent residency if you want to live in the United States.

The best way to get an unlimited right to live in the United States is to take advantage of the high odds of winning the Green Card Lottery. Lottery participation takes only a few minutes, and if you win, it will make your life in the USA much easier.

DE

DE EN

EN ES

ES FR

FR IT

IT PL

PL TR

TR UA

UA