Buying a house in the USA

Would you like to fulfill your American residential dream of buying a house in the USA? We explain the steps you need to take when purchasing real estate in the United States.

- Homeownership in the USA

- Types of real estate in the USA

- How much does a home in America cost?

- Development of real estate prices in the USA

- Where can you find the cheapest real estate in the USA?

- Buying a house in the USA as a foreigner

- Step-by-step guide to buying a house in the USA

- Plan your budget

- Search for offers

- Get professional advice

- Compile your documents

- Find a new home

- Conclude the contract

- Contact the utility companies

Take the chance of living in the USA and apply for the official US Green Card Lottery!

Homeownership in the USA

Buying a house is very common in the USA. Most residents of the United States are homeowners. According to the U.S. Census, the homeownership rate in the USA will be around 65.6 % in 2024.

If you have already decided that you want to stay for a longer period of time in a certain place, buying real estate is even cheaper in many cases than renting an apartment on a long-term basis.

Types of real estate in the USA

What do you want your American dream home to look like? If you dream of buying a house in the United States, you need to figure out what type of property you would like to reside in in the future. Typically, in the United States, there are:

Condos

Condominiums, or condos, are usually found mainly in urban areas. They have one or more rooms, a kitchen, a bathroom, and in some cases, a balcony.

By the way, apartment ads in the US only specify the bedrooms. The kitchen and living room are considered self-evident. So when you see an offer for a 1-bedroom apartment, it actually has two rooms (a living room as well as a bedroom). Apartments that consist of just one room are called "studios" in the USA.

At times, condominiums are located in apartment complexes that also include fitness rooms, tennis courts, a pool, or a clubhouse.

Townhouses

Townhouses are tall and narrow buildings that are constructed side by side to save space. They have small backyards and are designed for living in urban areas. Townhouses are generally also attached houses.

Attached houses

Attached houses or multi-family homes are buildings that have connecting walls to the neighboring houses on both the left and right sides. They usually include a small garden behind the building and an inviting entrance area in front of it.

Semi-attached houses

Another widespread form of housing is semi-attached houses. We talk about a semi-attached house when two separate independent buildings are divided by a so-called firewall, i.e., two houses are connected only in the middle. A characteristic feature of a semi-attached house is that both halves are symmetrical.

Detached houses

Detached houses, also called single-family homes, dominate in rural areas and suburbs. These are freestanding residential buildings in which only one family lives. They usually have a garage, a driveway, as well as front and backyards.

Bungalows

Bungalows are small single-family homes. Typically, they are square, have one floor only, and are found mainly in American suburbs.

Tiny Houses

Minimalist and cost-saving tiny houses are a new trend in the United States. According to the 2017 US Building Code, tiny houses may have a height of 4.11 m and a floor area of up to 400 square feet (about 37 m2). In the USA, tiny houses can be stationary or mobile, meaning they can be towed by a car like a trailer.

Good to know

When buying a house in the USA, you can save money on furniture and appliances, as some of it is already built in. In American houses and apartments, you will typically find built-in cabinets and walk-in closets. In some cases, kitchen furniture and appliances are also already in place.

How much does a home in America cost?

The question of what an average home in the USA costs cannot be answered briefly. Real estate prices vary greatly depending on the state and the environment.

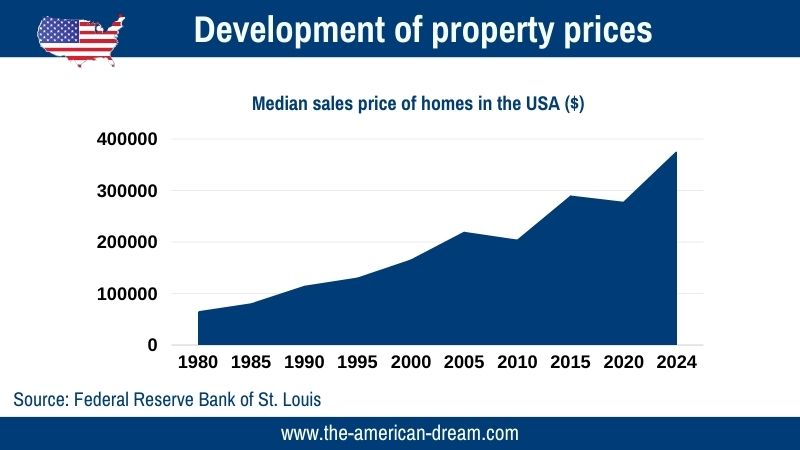

Development of real estate prices in the USA

Property prices in the USA have risen sharply over the past 40 years. While the purchase price for an average home in America was still around $ 65,000 in the early 1980s, it averaged around $ 376,000 in the first quarter of 2024, according to the Federal Reserve Bank of St. Louis. The sales price of US real estate is expected to continue to rise in the coming years, although the exact extent of these increases remains uncertain.

Where can you find the cheapest real estate in the USA?

The purchase prices for apartments and houses in America vary enormously from state to state. For example, an average home in the most expensive state of Hawaii currently costs about 7.5 times as much as a property in the most affordable state of West Virginia.

In addition, there are major differences depending on the surrounding area: while major cities and popular locations, e.g., near the beach, have high prices, housing in rural areas is comparatively inexpensive.

This is the average cost of a home in the USA in 2024:

- Iowa: $ 230,600

- Ohio: $ 240,900

- Kentucky: $ 251,300

- Michigan: $ 252,200

- Oklahoma: $ 253,200

- Missouri: $ 255,400

- Louisiana: $ 257,400

- Indiana: $ 258,000

- Arkansas: $ 258,100

- North Dakota: $ 259,900

- Mississippi: $ 271,200

- Wyoming: $ 276,000

- Kansas: $ 276,300

- Pennsylvania: $ 278,700

- Illinois: $ 280,900

- Alabama: $ 284,900

- Nebraska: $ 290,500

- Wisconsin: $ 297,100

- West Virginia: $ 304,400

- South Dakota: $ 306,800

- Delaware: $ 327,300

- Minnesota: $ 341,700

- New Mexico: $ 349,200

- Texas: $ 357,800

- North Carolina: $ 371,100

- Maine: $ 373,700

- South Carolina: $ 374,200

- Georgia: $ 375,300

- Tennessee: $ 377,200

- Alaska: $ 379,600

- Vermont: $ 385,300

- Connecticut: $ 393,700

- Florida: $ 407,200

- Maryland: $ 421,800

- Nevada: $ 428,100

- Arizona: $ 436,100

- Virginia: $ 440,200

- New Hampshire: $ 452,700

- Idaho: $ 460,900

- Rhode Island: $ 462,100

- Montana: $ 466,300

- New Jersey: $ 477,600

- Oregon: $ 510,900

- Utah: $ 529,600

- Colorado: $ 580,900

- Massachusetts: $ 614,700

- Washington: $ 618,000

- District of Columbia: $ 668,250

- Hawaii: $ 720,200

- California: $ 785,900

- New York: $ 819,900

Buying a house in the USA as a foreigner

Buying a house in the USA is possible and even fairly easy not only for American citizens and Green Card holders but also for foreigners.

If you do not have US citizenship or a Green Card, then you have the option of applying for an Individual Taxpayer Identification Number (ITIN). With this, foreigners who are not able to obtain a social security number can obtain a tax number.

Contact the Internal Revenue Service (IRS), an agency within the US Department of the Treasury, to request an ITIN. They will ask you to complete the W-7 Form. Depending on your nationality, you may also need a valid passport or other identification documents (e.g., a driver's license) and a valid visa.

Will buying a house in the USA help me get a Green Card?

No, buying a house in the USA is not a path to a Green Card. You can only obtain a Permanent Resident Card through employment, investment, family reunification, or by winning the Green Card Lottery.

Step-by-step guide to buying a house in the USA

To buy a house in the USA, you will roughly follow these steps:

Plan your budget

The first step to buying a house in the USA is to plan your budget. Estimate how much money you have available and how much you need to buy a house.

If you do not have enough money to buy a property, consult your bank for information on obtaining a loan. However, before you contact a bank, check your credit score.

Search for offers

To hunt for the right property, you have several options. These include, for example, various online portals. Among the best websites for real estate search are:

- zillow.com

- realtor.com

- trulia.com

- foreclosure.com

- apartments.com

- fsbo.com

- homesforheroes.com

However, you can also seek the help of brokers (realtors or real estate agents) or real estate agencies that will assist you in finding and buying a house in the USA.

In addition to the price and the type of property, also look at the location of your potential new home. For example, assess in advance its access to public transportation, stores, schools, parks, and other amenities.

Get professional advice

Each of the 50 US states establishes its own laws regarding real estate acquisition. Once you have decided on a state to live in, you should seek advice from an attorney or a broker. They will advise you on all of the state's regulations, tax requirements, necessary paperwork, and legal issues.

Compile your documents

After you have fully researched the regulations in your desired location, you can begin to gather all the documents necessary when buying a house in the USA. As a rule, you will need:

- Proof of identity (e.g., US driver's license, Green Card)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Bank statements

- Pay statements

- Tax return forms

- Additional documents, if applicable (depending on the state and personal situation)

Find a new home

It's now time to personally tour the houses that qualify as your future home. Once you've found the property of your dreams, it's time to declare your interest. Make an offer and begin negotiations. Then, have the purchase agreement sent to you and make the first payment, if necessary.

Conclude the contract

For the closing phase of the home purchase, you can also hire a closing agent. This agent will help you review all necessary documents and arrange payments prior to the conclusion of the home purchase.

Budget about 1 to 2.25 % of the total home price on top of additional costs involved in the home purchase in the United States. These may be for:

- Settlement and notary fees

- Legal fees

- Certification fees

- Insurances

If you are not in the United States, you do not necessarily have to enter the USA to conclude the purchase, but you can also issue a power of attorney. In doing so, you authorize another person to represent you and sign on your behalf.

Contact the utility companies

The purchase contract for your house in the USA is signed and sealed? Congratulations! Before you can move into it, you now need to contact the necessary utility companies to set up an account. This involves:

- Water

- Electricity

- Gas

- Telephone / Internet

- Cable TV

In most cases, utilities will require the following documentation to set up your customer account:

- Valid proof of identity (e.g., US driver's license, Green Card)

- Proof of ownership of the property

- Credit score

- Proof of US bank account

- Social security number, if applicable

- Proof of employment, if applicable

Do you have further questions about buying a house in the USA? You will certainly find what you are looking for in our FAQ:

When looking for a real estate agent to help you buy a home, you will come across the terms realtor and real estate agent. Both have a license to sell real estate. The difference between the two is that a Realtor is a member of the National Association of Realtors and follows their code of ethics.

Even if you are not a US citizen or Green Card holder, you may purchase almost all types of condominiums, single-family homes, and multi-family buildings. You will only find restrictions for housing cooperatives in the US, which often have regulations that prohibit foreign ownership.

Yes, it is legal in the United States to pay cash for a property. It may even have some advantages: for example, in some cases, you can save fees on mortgage applications, loan origination, and insurance. Note, however, that cash payments of $ 10,000 or more must be reported according to US law.

More tips for the USA

Buying a house in the USA is not yet an option for you? Then take a look at our guide to renting an apartment in the United States. Also, sign up for our The American Dream newsletter, which brings the latest America news to your inbox every week!

DE

DE EN

EN IT

IT TR

TR